Having $2,000 to $3,000 to invest is a good feeling, but how you allocate those funds can impact your finances more than you might realize. Where investing your small nest egg and adding to it regularly can lead to significant returns over time, stuffing $2,000 to $3,000 in cash under your mattress can mean losing money to inflation over time.

Before you decide where to invest $2,000 to $3,000, think about when you’ll need the money. While some options are designed to keep your money safe in the short term, taking on more risk can yield better results over the long run.

To help you figure out what to do, here are 17 of the best strategies for investing $2000 to $3000.

Best Short-Term Investments for $2,000 to $3,000

While investing $2,000 to $3,000 can help you make progress towards any number of financial goals, there are situations where you may need to access your money in the near term. Maybe you’re trying to save up a down payment for your first home, or perhaps you are saving for a major renovation project or college tuition.

In any case, the investment options below will help you protect the principal of your investment while securing some return.

1. High-Yield Savings Account

High-yield savings accounts come with FDIC insurance, meaning your deposits are federally protected in amounts up to $250,000 per depositor per account. But while you won’t lose any money by investing your $2,000 to $3,000 in one of these accounts, you’ll have to settle for a lower return.

Fortunately, today’s rising interest rate environment means you can earn more in a savings account than you could just a year ago. For example, opening a UFB Elite Savings account with UFB Direct can help you earn a 3.11% APY with zero monthly maintenance fees and no minimum deposit requirement.

While earning a little over 3% back on your savings won’t help you get rich, it can help you keep up with inflation while protecting your cash until you need it.

2. High-Yield Certificates of Deposit

You can also look into high-yield certificates of deposit, or CDs, which require you to commit to saving for a specific length of time (usually a few months to several years). You can cash out your CD and get your principal back (plus interest) once the term of your CD ends, yet you’ll be charged a penalty if you need to access your CD before it reaches maturity.

Certificates of deposit (CDs) also tend to offer higher interest rates than savings accounts, although minimum balance requirements can apply.

Where can you find the best CD rates? A platform called SaveBetter offers high-yield certificates of deposit (CDs) through various banks and credit unions, some of which offer yields over 4% at the moment with a minimum deposit requirement of just $1 to get started.

3. Short-Term Corporate Bond Funds

Short-term corporate bond funds can help you preserve capital while creating income, and they do this by investing in corporate bonds with maturities ranging from one to three years. These funds tend to offer better long-term yields than savings and money market accounts, although returns are not guaranteed, and these funds are not risk-free.

If you’re considering short-term corporate bond funds as part of your investment strategy, you can get started with brokerage platforms like Zacks Trade and TD Ameritrade.

4. Money Market Account

You can also consider investing your $2,000 to $3,000 in a money market account, which works similarly to a high-yield savings account. While money market accounts tend to have higher minimum deposit requirements than savings accounts, they often come with checkbooks and debit cards that make it easier to access your money if needed.

Once again, UFB Direct stands out in this space due to its exceptional money market account yields with the potential for no fees. The yield on their money market account is currently set at 3.11%, and you can benefit from perks like online account access, mobile deposit, and check-writing privileges.

Remember that their money market account charges a $10 monthly maintenance fee on accounts below $5,000.

- * No minimum deposit required

- * No maintenance fees

- * 24/7 access to your funds

- * FDIC insured

5. Series I Savings Bonds

Series I Savings Bonds (also called I Bonds) offer another risk-free way to grow your initial investment, and they’re an excellent option if you only have $2,000 to $3,000 to invest right now. This government-backed bond option lets you invest up to $10,000 per year without any risk of losses, and the current rate for I Bonds is set at 9.62%.

This rate goes up and down over time, and you should know that you must keep your money invested in Series I Savings Bonds for a minimum of one year. Also, note that you’ll pay a small penalty (three months of interest) if you need to access your money within 60 months after your initial investment.

This makes I Bonds slightly less liquid than other options like high-yield savings accounts, although the return you’ll receive will be much higher over the long term.

6. Pay Down High-Interest Debt

Paying down high-interest debt may not feel like investing, but you will secure a return in proportion to the interest rate you’re paying.

Next up, consider paying down high-interest debt, such as credit card debt or car loans. While paying down debt may not feel like you’re investing in a traditional sense, this strategy can help you secure a return in proportion to the interest rate you’re paying.

For example, let’s say you owe $3,000 in credit card debt on a card with a 19% APR. If you paid just $85 per month on the card until your balance was paid off, it would take 53 months to become debt-free, and you would pay $1,428 in credit card interest along the way.

If you took $3,000 in cash and used it to pay off that credit card balance, however, you would effectively save $1,428 in interest and free up more of your income to invest from that point forward.

Best Strategies to Invest $2,000 to $3,000 for the Long-Term

While the strategies I have suggested are good, you still need to consider your investment timeline. If you have five or more years to invest or are willing to take on more risk to secure a higher return, you’ll likely want to consider a different set of options altogether.

Remember that taking on more risk can mean losing money, especially in the first few years. Here are some of the best ways to invest $2,000 to $3,000 if you want to focus on building wealth and know you won’t need to access this money immediately.

7. Invest in the Stock Market

For as long as anyone can remember, investing in the stock market has been one of the best ways to build wealth over the long term. While the market was down significantly in 2022, it’s crucial to remember that the average annual stock market return is around 7% after accounting for inflation.

Your $2,000 to $3,000 investment will multiply with that kind of return. If you invest $3,000 today and earn 7% for the next 25 years, for example, you’ll wind up with $16,282.30 without adding another dime to your account.

But where and how should you invest in the stock market? While you can always invest in individual stocks and hope for the best, it can make sense to spread your investment out over many different investments.

You can do this through a platform called M1 Finance, which lets you create or select from investment “pies” spread out across many different stocks and exchange-traded funds (ETFs) through fractional shares.

Not only can you create a custom pie of investments, but you can choose from expertly curated pies that were created to fit different investment timelines and risk profiles. Best of all, M1 Finance lets you invest commission-free, and you can manage your account on the go with the platform’s highly-rated mobile app.

- * Account Minimum $100

- * Build custom portfolios (or)

- * Choose expert portfolios

- * Stocks, ETFs, REITs

8. Real Estate Crowdfunding

Investing in real estate is another smart way to build long-term wealth, yet not everyone wants to be a landlord. Not only that, but today’s mortgage rates make turning a profit on rental real estate considerably more difficult than just a few years ago.

Fortunately, you can invest in real estate much more passively with help from a platform like Fundrise or Realty Mogul. Both companies let you invest in various types of real estate, from commercial to residential, and you never have to deal with unruly tenants or building maintenance and repairs.

Fundrise is one of my favorite investment strategies, mainly because it’s passive, and you have the potential for excellent returns with relatively low fees. You can begin investing with Fundrise with as little as $10, and the company’s investors saw average returns of 7.31% in 2020 and 22.99% in 2021. So far in 2022, Fundrise investors have seen average returns of 5.40%.

You can learn more about investing in Fundrise in my Fundrise Review, or get started with Fundrise using my exclusive link below:

- * Invest in real estate with $10

- * Open to all investors

- * Online easy to use site and app

9. Open a Roth IRA

If you have $2,000 to $3,000 to invest and want to use that money for retirement, you may want to consider opening a Roth IRA. This retirement account lets you invest with after-tax dollars, meaning you don’t get a tax benefit upfront. However, your money grows tax-free, and you won’t have to pay income taxes when you withdraw the money after retirement.

Another Roth IRA secret is that you can withdraw your contributions (but not earnings) before retirement age without paying the penalty. You can invest in a Roth IRA and start to withdraw your contributions a few years from now, penalty-free if you need to.

You should also know that there are numerous platforms you can use to open a Roth IRA, and each has its pros and cons. For example, platforms like M1 Finance and Robinhood let you open a Roth IRA and choose your investments with no fees. Yet, a robo-advisor like Betterment can build your portfolio and manage your account in exchange for an annual management fee.

The chart below provides an overview of some of the best places to open a Roth IRA, as well as their benefits:

| Betterment | M1 Finance | Robinhood | |

| Annual Management Fees | 0.25% to 0.40% | None | None |

| Minimum Balance Requirement | $0 | $100 for investment accounts $500 for retirement accounts |

$0 |

| Investment Options | Stocks, bonds, ETFs, cryptocurrency, and more | Investment “pies” with fractional shares | Stocks, bonds, ETFs, cryptocurrency, and more |

| Reviews | Betterment Review | M1 Finance Review | Robinhood Review |

It’s worth noting that income caps limit who can contribute to a Roth IRA. If you’re a high-earner and wondering if you can qualify, head here before you open an account: Roth IRA Rules and Contribution Limits for 2022.

10. Start a Blog

Maybe you want to invest in yourself in some way or in a small business that can help you earn a somewhat passive income. A blog enables you to do that, although it may take some time – even several years – to get a return on your investment.

I should know. I started this website you’re reading more than a decade ago, and it took me at least a year to earn a steady income. Over time, I learned the ins and outs of digital marketing and what it takes to make a blog successful. And while I have had many ups and downs over the years and plenty of setbacks, I have easily used this website to earn millions of dollars! That’s the power of blogging!

The good news about starting a blog is that you won’t need $2,000 to $3,000 to get started. You may be able to build a simple template and set up hosting for your blog for a few hundred bucks.

If you’re curious about what it takes to get started as a blogger, start by reading this article: How To Start A Blog From Scratch And Make It Work.

In the meantime, consider signing up for my free Make 1k Blogging course. It teaches you exactly what to do to earn your first $1,000 online, and you can get free access from the moment you sign up!

11. Dividend Stocks

When you have $2,000 to $3,000 to invest, getting started with dividend stocks is another strategy to consider. Dividend stocks have the potential to increase in value over time, just like traditional stocks, yet they also pay out regular dividends (or payments) to investors. As a result, many people invest in dividend stocks to build passive income streams to fund their lifestyles or pay for early retirement.

Making $1,000 per month with dividend stocks is possible if you have a large enough portfolio and know what you’re doing. But if you only have $2,000 to $3,000 to invest right now, you’ll have to start from scratch.

One strategy involves investing in high-dividend-paying stocks known as Dividend Aristocrats. There are 65 different companies and dividend stocks on this list, and they are known for offering excellent yields over at least 25 years.

Dividend Aristocrats are prominent, established companies with a market capitalization of at least $3 billion. This means you’re investing in companies with a proven track record and a long history of positive returns.

Where can you invest in dividend stocks, including Dividend Aristocrats? Many platforms let you build a portfolio that suits your investment timeline and goals, but Robinhood and Webull let you invest with no commissions.

12. Health Savings Account (HSA)

If you have a high deductible health plan (HDHP), you can also consider investing $2,000 to $3,000 in a health savings account (HSA). These accounts let you get an immediate tax deduction in the year you contribute, and your money grows tax-free until you choose to use it for eligible healthcare expenses.

If you don’t use your money by age 65, you can use your HSA account funds for anything you want, although you’ll have to pay income taxes on distributions you take beyond that age. If you need to take a distribution before age 65, on the other hand, you’ll have to pay income taxes, and you’ll be charged a 20% penalty.

In addition to the fact this money will only be accessible penalty-free if you have eligible healthcare expenses, you also need to remember that contribution limits apply to this account each year. In 2023, individuals can contribute up to $3,850 to an HSA, while families can contribute up to $7,750. This amount exceeds last year’s limits of $3,650 for individuals and $7,300 for families in 2022.

Where should you open an HSA? A range of platforms let you open this type of account, and many let you invest your HSA funds in various underlying investments like mutual funds and index funds. Some of the best HSA accounts to check out include the Lively HSA and HSA Bank.

13. Invest in Income Accelerators

Another way to invest in yourself involves investing in something I call “income accelerators.” These are not traditional investments, yet investing $2,000 to $3,000 in an income accelerator can help you grow wealth in ways you have never imagined.

Some of the income accelerators I recommend include:

- Accelerated learning (i.e., reading books, taking an online course, attending conferences, etc.)

- Personal coaching (i.e., hiring a professional coach in your field or industry)

- Joining a mastermind group

- Hiring a mentor in your field

- Building relationships by investing in other people

If you’re curious about income accelerators and how they can help you increase your revenue and even find new ways to earn money, check out my new YouTube video on the topic:

14. Hire a Robo-Advisor

If you have $2,000 to $3,000 to invest but feel overwhelmed by all your options, it may be time to call in professional help. However, you don’t have to work with a traditional financial advisor who may be more interested in growing their wealth than helping you build up yours. Instead, you can opt for a robo-advisor that uses financial software to help you find the right investments for your risk tolerance and timeline.

While many online financial advisors are out there, some of the best robo-advisors include Betterment, M1 Finance, SoFi Money, Personal Capital, and Wealthfront. Each of these companies does things slightly differently, yet they all help you choose a customized portfolio that can help you grow your $2,000 to $3,000 over time.

Some robo-advisors are free to use, yet others charge an annual management fee to help you pick and manage your investments. The chart below highlights the best robo-advisors in operation today, plus their yearly fees and minimum balance requirements:

15. Invest in Crypto

You can also consider investing in crypto, although you’ll want to proceed cautiously if you do so. After all, the crypto scene has been incredibly volatile over the last year, and it appears crypto may not be the hedge against inflation many said it would be.

With that in mind, one of the best crypto strategies right now involves buying and holding — or even HODLing (holding on for dear life). This can make sense if you believe the value of popular cryptocurrencies like Bitcoin and Ethereum can only go up from here.

If you want to invest in crypto, you can open an account with any of the best crypto exchanges. The most prominent platforms to consider include Gemini, Binance.US, Coinbase, and KuCoin.

Once you open an account, you can immediately invest in Bitcoin and other cryptocurrencies. However, you should also research the best crypto wallets to keep your digital assets safe from hackers and thieves until you’re ready to sell.

16. Invest in Art and Collectibles

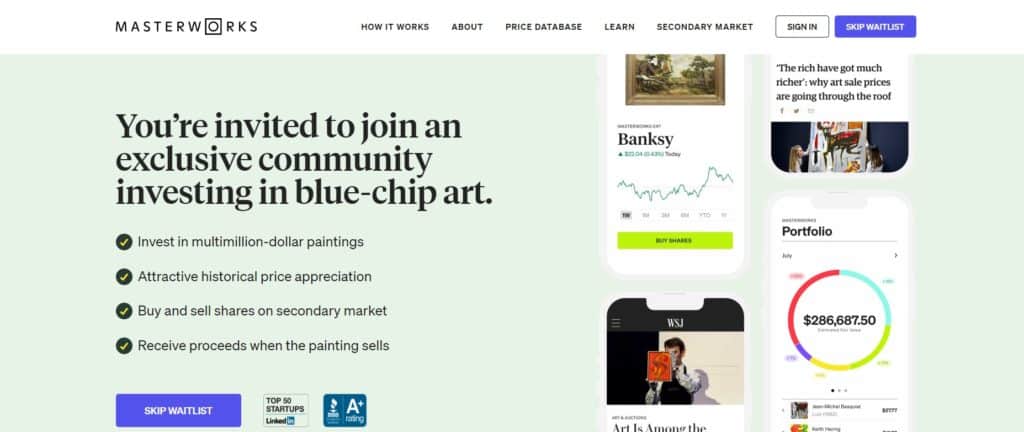

Investing in art sounds like something only rich people do, yet an array of online platforms let almost anyone invest in valuable artwork and collectibles. One example is a platform called Masterworks. This website lets users invest in various art pieces or even collections of art, and Masterworks investors have achieved net annualized realized returns of 29.03% to date.

Like real estate crowdfunding platforms, Masterworks lets you buy “slices” or fractional shares of multi-million dollar paintings and collections. You can sell your shares on the Masterworks secondary market or wait to receive proceeds from your investment when a painting sells. Either way, you should know that your investment won’t be entirely liquid and that you can lose money if you buy or sell at the wrong time.

In addition to art crowdfunding, you can consider investing in non-fungible tokens or NFTs. NFTs can be offered as digital pieces of art that can grow in value similarly to traditional artwork, although NFTs can also come in the form of digital real estate or virtual keepsakes.

Whatever you are into, you can buy NFTs on platforms like OpenSea and Rarible. Just remember that, like other investments with the potential for high long-term yields, you can lose money with NFTs in the short term.

17. Start a YouTube Channel

You can also consider starting a YouTube channel to grow your money, although you may not need to spend anywhere close to $2,000 to $3,000 to start the process. Creating a YouTube channel and building a following without an initial investment may be possible. However, you may get more traction upfront if you invest in a good camera, professional lighting, and some basic video editing software.

I can tell you from experience that I wasn’t sure what I was getting into when I started my own YouTube Channel called Wealth Hacker. However, I built it to the point where I now have nearly 400,000 subscribers! I also earn quite a lot on YouTube through sources like display ads and sponsorships.

If you’re ready to start making money on YouTube, you need to figure out a theme for your channel and a general idea of what you hope to accomplish.

Best Ways to Invest $2000 to $3000: Final Thoughts

If you’re looking for the best ways to invest $2000 to $3000, any of the options I outlined can help you achieve your goals. Keep your investment time horizon in mind and whether you’re willing to take on more risk to secure a higher yield over time.

If you don’t need the cash for at least five years and potentially not until retirement, you’re better off investing in the stock market or through a crowdfunding platform that has reported solid results. If you need a place to keep your money in the short term, a high-yield savings account, money market account, or certificate of deposit (CD) could be your best bet.

Cited Research Articles

1. FDIC Insurance. (2020, May 5). Federal Deposit Insurance Corporation (FDIC): Definition & Limits. Retrieved from https://www.investopedia.com/terms/f/fdic.asp

2. Treasury Direct. (n.d.) I Bonds. Retrieved from https://www.treasurydirect.gov/savings-bonds/i-bonds/

3. Dividend Power. (2022, Nov 29). The list of Dividend Aristocrats. Retrieved from https://www.dividendpower.org/2020/02/03/the-list-of-dividend-aristocrats-in-2020/