Taxes are our largest ongoing liability. As a result, it behooves us to optimize our taxes as much as possible. This post will discuss all the smart money-saving tax moves to make by year-end. It gets updated once a year to follow new tax laws.

After fake retiring in 2012, my desire to make maximum income went away. Instead, I wanted to shield as much income from taxes as legally possible. Paying six figures in taxes a year for more than a decade felt good enough. My goal was to limit total individual income to under $200,000.

After ~$200,000 per person and $250,000 per married couple, the Alternative Minimum Tax kicks in. Meanwhile, deductions start aggressively phasing out. Even in expensive San Francisco, there’s no need to make more than $200,000 a year to live a comfortable lifestyle.

Income Target And Tax Optimization After Kids

Thanks to lifestyle inflation, economic inflation, and the need to now support a family of four, I’ve got a new household income target of up to $400,000.

$400,000 is certainly not a necessary household income to live well. It’s just my ideal income level where you earn enough to do what you want, but aren’t getting crushed by taxes.

A 25% – 30% effective tax rate is high enough to feel like you’re contributing to society. But it’s also not so high where you’re feeling robbed by the government.

After about $200,000 per person or $400,000 for a family of up to four, I’ve noticed there is no incremental increase in happiness. Instead, making more money often creates more misery due to more work and more stress.

For hardcore tax optimizers, the ideal household income may be closer to a MAGI of $340,100 based on 2022 income tax rates. Up to $340,100, a married household’s marginal income tax rate is a reasonable 24%.

The majority of actions to reduce your taxes must take place during the calendar year. So if you want to pay less taxes, it’s time to get cracking.

Money-Saving Year-End Tax Moves To Make

Here are all the smart money-saving year-end tax moves to make. I revise the suggestion every year due to constantly changing tax laws and input from readers.

1) Charitable Donations

Being able to give your time and money away to worthy causes is one of the best benefits of being financially independent. No longer will you always feel conflicted about whether you should save and invest your next dollar versus helping someone in need. You just tend to give more because you can.

Guidelines to claim deductions on charitable donations:

- You’ll need to itemize deductions and file Form 1040.

- The charity organization must be qualified with the IRS and be actively tax exempt. This excludes political candidates and organizations, as well as individuals.

- Used items such as housewares and clothing must be in good condition or better for them to be deductible.

- Donated vehicles can be deducted at fair market value if you meet certain requirements. For example, the charity must sell your car well below market price to a person in need, or the organization must make major repairs to increase the car’s value. Alternatively, you could qualify if the charity will use the car for purposes such as delivering meals to needy individuals.

- If the total of your non-cash contributions is greater than $500, you’ll need to file Form 8283.

- You’ll need a written record of all cash donations with the date, amount, and charity name.

- And if you receive goods or services for a donation, you can’t deduct your entire contribution. The value of what you received must be less than your donation, and you can only deduct the difference.

- If you are volunteering and performing services for a charity using your car, you can deduct mileage.

- Travel expenses can be deducted if you go on a trip with a qualified charitable organization and you’re “on duty in a genuine and substantial sense throughout the trip” per the IRS.

- Donations of property are generally deducted at fair market value based on what they would sell for on the open market.

- You can avoid capital gains on appreciated stocks held over a year if you donate them to a charitable organization. The amount you can deduct is determined by the stock’s fair market value on the contribution date. Consider setting up a Donor Advised Fund for greater impact.

Giving Percentage Rates By Income

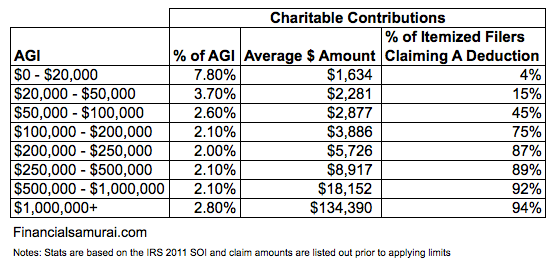

Here are some interesting statistics on average charitable contributions based on income for individuals claiming itemized deductions.

It is great to see the sub-$20,000 income group give away such a high percentage of their income. When I was working minimum wage service jobs, we tended to tip well to fellow minimum wagers. At lower income levels, it’s all about giving and helping each other survive.

Here’s another giving by income chart from the National Center For Charitable Statistics. It’s interesting to see the income groups that give the least earns between $200,000 – $1,000,000.

The reason is likely because this income group pays the most in taxes and earns the majority of income through W-2 income. After all, paying taxes is a form of charity since your tax dollars get redistributed to help others.

I’ve written a lot in the past about how households making $300,000, $400,000, and $500,000 a year in expensive cities are just living regular middle-class lifestyles. Part of the reason why is because a huge percentage of their income is going towards taxes.

Once you get over $1 million a year in income, a greater percentage of income tends to come from investments. And investments are taxed at a lower rate.

Accelerate your charitable contributions to the current year if you want to lower your tax bill. One way to give is to strategically use your credit card when making a donation. Deductions are based on the date your card is charged, not the date you actually pay your credit card bill. In other words, you can make a donation via credit card on December 30, 2022 and not have to pay it off until January 2021.

2) Capitalize Losses On Bad Investments

If you own securities or property that have been declining and you’re below your cost basis, consider liquidating before year end if you don’t anticipate a recovery.

Losses on property held for personal use can’t be deducted. Only investment property losses can be written off. And you’ll also need to look at the net of your capital losses and gains. If your gains are higher than your losses, you’ll owe money on the difference.

Under the tax code, an individual may deduct up to $25,000 of real estate losses per year as long as your adjusted gross income is $100,000 or less and if you “actively participate” in managing the property. The deduction phases out as an individual’s income approaches $150,000. Individuals whose adjusted gross income exceeds $150,000 are not eligible for this deduction. This income threshold hasn’t changed for a while.

Note that you cannot deduct rental losses to your active income (e.g. day job income). Rental losses can only be deducted from passive income. You report your rental income and deductible expenses on IRS Schedule E. The IRS reports that roughly half of the filed Schedule E forms show losses.

Your big stock losses can offset any big gains in the calendar year. Any further losses can be carried over to the tune of $3,000 in capital loss deductions a year.

3) Increasing Expenses During Good Years

It’s good practice to anticipate and prepare for changes to your income in the upcoming year.

You should also increase your necessary expenses during a great income year. If you are having a bad income year, then defer such expenses until income improves. This is one of the best year-end tax moves to make for business owners.

If you are an employee, you can ask your employer to pay your year-end bonus in the following year if you want to defer income. Just make sure your employer will be around to pay you in the future.

4) Contribute To Tax Advantageous Retirement Accounts

You can make additional contributions to your 401k before year-end if you haven’t already maxed it out. The 2022 401(k) maximum contribution amount is $20,500. If you are a sole-proprietor, don’t forget to contribute the maximum to your solo-401(k).

In addition, you can make current year IRA and Roth IRA contributions until April 15 the following year. Or, you can wait to see what your modified AGI will be and then contribute accordingly.

For those of you who have experienced a particularly difficult year due to a job loss or other reasons, it may be beneficial for you to covert your traditional IRA into a Roth IRA. The Roth IRA conversion is a taxable event. However, the idea is to convert your traditional IRA when your marginal federal income tax rate is at its lowest point. Once taxes are paid on a Roth IRA, it grows tax-free and can be withdrawn tax-free.

In general, I’m not a fan of paying taxes up front with a Roth IRA, especially if you are in the 24% marginal income tax bracket or higher. If you are struggling financially, it may be even more difficult to bite the bullet and convert, despite being in a lower tax rate.

For high-income individuals looking for a workaround for the income limits on Roth IRA contributions, the backdoor Roth conversion is a solution. A nondeductible contribution can be made and then converted tax-free to a Roth IRA. This works because there are no income limits on non-deductible traditional IRA contributions or on Roth IRA conversions. However, be careful of the pro-rata rule.

The deadline to do a backdoor conversion for 2022 is Dec. 31. Congress seems highly motivated to eliminate the backdoor conversion in the future.

5) Deduct property tax

Property tax is an expense against rental income. Therefore, don’t forget to deduct it. Your primary mortgage property tax is also a deductible expense on your taxable income.

6) Business Tax Moves

A business which is cash-based, not accrual-based, can defer taxable income to the following year by sending December invoices at the very end of the month. The reason this can work is the business won’t receive payment for those invoices until January or later, and the business’ taxable income isn’t captured until the date the cash comes in.

Companies and sole proprietors can also reduce taxable income in the current year by charging business related expenses in 4Q that they’d normally take in Q1 of the following year. If you expect your business to grow rapidly in the following year, then wait until the following year to load up on capital expenditure.

If you’re having a great business year, wait until the new year to cash your November and December checks in January. Although, there’s always a risk the vendor might disappear or go bust before you can cash your check. Make sure you know what the time limit is for cashing in a check as well.

Maximize Business Expense Deductions

One of the best year-end tax moves to make include maximizing your business deductions. If your business needs a vehicle and also is having a great year, consider buying a 6,000+ SUV or truck by 12/31. Let’s say you buy a $90,000 Range Rover Sport and use it 100 percent for business. Tax law allows you to deduct $90,000 (or a lesser amount if you would like – in this case, you use Section 179 expensing).

If the Gross Vehicle Weight is 6,000 pounds or less, your first-year write-off is limited to $10,000 ($18,000 with bonus depreciation as limited by the luxury auto limits). You can learn more about the tax rules for writing off a vehicle here.

Finally, a great private business strategy is to hire a close friend or relative who is in a lower tax bracket than your business tax bracket. Your friend or relative earns money while your business reduces its taxable income and receives services.

For example, you could hire your high school son for $6,000 to redesign your website. His $6,000 in earnings is tax-free given the standard deduction is much higher. Meanwhile, you reduce your taxable income by $5,000. Further, you hopefully get a slick new website while teaching your son about work.

The $6,000 earned by your son can then be invested in a Roth IRA. The income goes in tax-free, compounds tax-free, and gets to be withdrawn tax-free. As a result, opening up a Roth IRA for your children is a no-brainer! Both sides win.

Related: 10 Reasons Why Starting An Online Business

7) Review Your Flex Spending Account (FSA)

Another great year-end tax moves to make is to make sure you don’t lose any money in your flex spending account. Check with your employer if your plan is eligible for a rollover of unused funds until March 15 of the following year.

If you’ve already run out of funds in your FSA but have things like medical work or fillings to do at the dentist, try to postpone them until next year if they aren’t urgent. That way you can save on taxes by allocating enough funds in next year’s FSA to cover those expenses.

If you’re planning on leaving Corporate America next year, get your physical done this year (usually free under preventative care). Also consider going to specialists to treat specific injuries. Maybe you need an MRI for a bum knee. Maybe you should finally see a pulmonologist for your asthma or COPD.

Try and get your money’s worth when it comes to healthcare. Don’t neglect physical ailments that are bothering you. They might get worse and more difficult to fix in the future.

See: Is A High Deductible Health Plan Worth It To Save In An FSA?

8) Consider Revising Your Withholding

Even though you probably submitted your W-4 form to your employer ages ago, you can still file a revised form to make adjustments to the remaining pay periods left in the year. If you anticipate you haven’t withheld enough taxes so far this year, you can increase your withholding to help reduce penalties and fees when you file your taxes.

Check if you’ve already paid 100% of your current tax liability this year. If so and your AGI is less than ~$150,000, you should be able to avoid being charged a penalty. But you’ll need to have paid 110% of your current tax liability in the year to avoid getting dinged if your AGI is above ~$150,000.

This safe harbor method is generally the easier option to avoid paying a penalty. The alternative is to have withheld 90% of your tax liability, which can be difficult for freelancers and independent contracts to calculate.

If you are earning both W-2 wages and 1099 income, bumping up your January 15th estimated tax payment to compensate for having underpaid in previous quarters doesn’t work. Each quarter is treated separately with estimated taxes. However, withheld taxes on paychecks are treated as if they were paid throughout the whole year.

9) Review Your Retirement Contributions To Date

The maximum 401(k) contribution limit is $20,500 for 2022 and $22,500 for 2023. You should max out your 401(k) if you are in the 24% marginal federal income tax bracket or higher to save on taxes. Maxing out your 401(k) every year is one of the best year-end tax moves to make.

Even though this is the season of giving, don’t forget to pay yourself first. Take a look at how much you’ve contributed to your retirement accounts so far to date. Then make additional contributions to the maximum.

Check your paystub to see how much you’ve contributed to your 401(k) plan to date. Now contribute the difference between the maximum contribution and what you’ve contributed.

10) Set Up A Revocable Living Trust

If you haven’t talked to an estate planning lawyer yet, please do so. Setting up a revocable living trust is vital if you have dependents. Not only does a revocable living trust help protect your assets, it also helps with the orderly distribution of assets in case of your untimely demise. Finally, a revocable living trust is usually cheaper than going through probate court. The public has access to all your finances in probate.

While on the topic of estate planning, please put together a Death File as well. The Death File is like a hyper-detailed will that includes all your accounts, passwords, important people to contact, and your wishes. You should also include audio and video recordings in your Death File as well, so there is less ambiguity.

11) Maybe Finally Get Married

The marriage penalty tax has all but disappeared after the Tax Cuts and Jobs Act was passed in 2017. If you’ve been on the fence about marrying due to a higher tax bill, you really don’t have to worry any more.

It’s only married couples making over $500,000 who will likely pay more taxes together than as unmarried individuals. If one partner earns an income in the $200,000 – $400,000 range, while another partner earns income below $100,000, there will likely be tax benefits if the couple gets married.

12) Start A Business

Starting a business might be too late as a year-end tax move. However, there’s always next year!

You can either incorporate as an LLC or S-Corp or simply be a Sole Proprietor. As a sole proprietor, no incorporation is necessary. Just file a Schedule C and 1040.

For 2023, every business person can start a Self-Employed 401(k) where you can contribute up to $66,000 ($22,500 from you as an employee and ~20% of operating profits from the business). In other words, to contribute the maximum to a Solo 401(k), your business needs to make around $240,000 in operating profits.

Further, all your business-related expenses are tax deductible as well. If you want to go to Hawaii to see a prospective client, you can deduct your travel-related expenses. If your parents so happen to live in Hawaii, it’s like getting a discounted trip to see them.

The first step is to launch your own website to legitimize your business. The next step is to obviously go try and make some income! Most expenses related to the pursuit of such income should be considered a business expense. Below is an income statement example from a sole proprietor.

13) Contribute To A 529 Plan

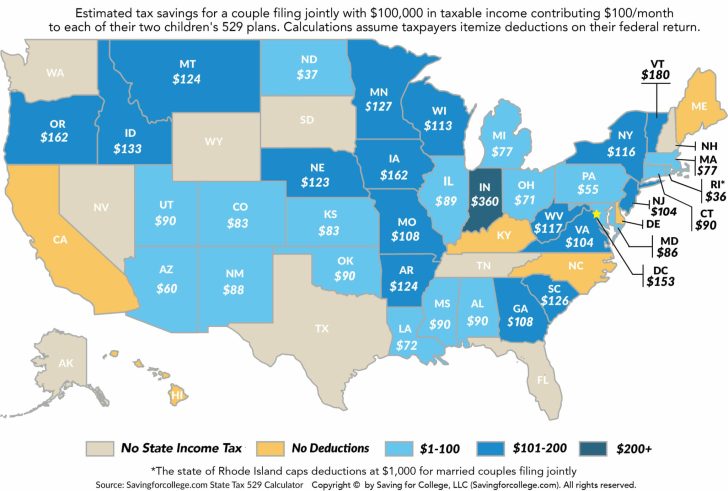

Over 30 states, including the District of Columbia, currently offer a state income tax deduction or tax credit for 529 plan contributions. For example in New York you can deduct $10,000 in contributions per year from state taxes.

At a 6% state tax rate that would save you $600 in taxes. Then, of course you get tax-free growth as long as the funds are spent for college. The 529 plan is one of the best tax-efficient ways to transfer wealth across generations.

As a parent, I’d rather give the gift of education rather than money. If I’m blessed with being a grandparent, I will superfund every grandchild’s 529 plan.

Study Up On The Latest Tax Rules

We all need to spend several hours each year reviewing and understanding the latest tax rules. Given the tax code is tens of thousands of pages long, spending several hours a year learning them is the least we can do.

Every year, there are many new propositions and tax laws that pass that may affect your future tax liabilities.

For example, California recently abolished Proposition 58 in place of Proposition 19. The new proposition reassesses the value of a rental property to market rate when it is passed to a child. This way, California can charge higher property taxes. For a primary residence, the value is also reassessed to market rate with a $1 million buffer.

Pay Attention To The Latest Estate Tax Exemption Amounts

Perhaps the most interesting tax information we should pay attention to are changes in the estate tax exemption amounts. If you are fortunate enough to have a household net worth higher than the estate tax exemption amount, more intentional spending and giving is in order.

By 2025, the Tax Cut And Jobs Act will expire. Under Joe Biden, there’s a high chance the estate tax threshold may go back down. For 2023, the estate tax exemption amount is an impressive $12,920,000 per person and $25,840,000 per married couple.

Let’s say the estate tax threshold per person declines to just $5 million per person in 2026. You currently have a $10 million net worth, the ideal net worth amount for retirement. If you die in 2026 and your net worth stays flat, you will have $5 million in estate tax exposure, or an estimated $2 million tax bill!

Please make realistic net worth and mortality projections. Paying a death tax on wealth you’ve already paid taxes on is a true waste.

Hopefully this article has given you some good year-end tax moves to minimize your tax liability.

Pay Your Taxes With Pride

For those of you who are paying more in taxes than the median household makes a year (~$75,000 in 2022), feel proud that you are contributing to society. Paying taxes could even be considered a form of charity after a certain amount.

Taxes are used to pay for defense, healthcare, infrastructure, food and shelter assistance programs, public schools, and more. If these things are considered good, then paying taxes should also be considered good.

It’s understandable that some people want to raise taxes on others without having to pay more themselves. Most working Americans don’t pay income taxes. However, if you are one of them, change your mindset.

Hopefully these great year-end tax moves will help you save money!

Reader Questions And Recommendations

Readers, what other smart money-saving year-end tax moves do you recommend making before year-end? What are some new tax rules for 2023 we should be aware of?

Pick up a copy of Buy This, Not That, my an instant Wall Street Journal bestseller. The book helps you make more optimal investing decisions so you can live a better, more fulfilling life. BTNT is on sale on Amazon right now.

For more nuanced personal finance content, join 55,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.